Review and update: Our Fair ‘Economic’ Share – Tristone’s Alberta Royalty Review Assessment

By Tristone Capital Inc. in Energy Politics Archives Fall 2008

Review of Our Fair Economic Share – Tristone’s Alberta Royalty Review Assessment (2007)

In the latest version of our working history series, we revisit Tristone Capital's 2007 report offering a critical response to the Alberta Royalty Review Panel’s recommendations to increase provincial royalties on oil and gas production. While expressing general support for the principle that Albertans should receive a “fair share” of resource revenues, Tristone forcefully argues that the proposed royalty reforms were based on flawed data, outdated cost assumptions, and inadequate economic analysis. The central thrust of the critique was that the reforms would not result in the predicted $2 billion revenue windfall, but rather reduce both investment and production, leading to a net loss for the province. They were absolutely correct on both fronts.

Tristone highlighted several key concerns many of which are still relevant today:

Inadequate return modeling: The report argues that metrics such as rate of return and profitability ratios were ignored in favor of a simplistic “government take” analysis.

Misleading assumptions: The government’s use of 2005 cost structures, unrealistic capital efficiency metrics, and oversimplified gas price assumptions led to distorted economic forecasts.

Negative investment signal: The proposed Oil Sands Severance Tax (OSST) and lack of deep well incentives, in Tristone’s view, would discourage high-risk, high-reward exploration.

Diminished competitiveness: By comparing Alberta’s royalty regime to jurisdictions like Texas, Saskatchewan, and the U.S. Rockies, Tristone concludes that Alberta would become a less attractive destination for capital.

Macroeconomic ripple effects: The report projects lower employment, reduced tax revenue, and decreased municipal royalties, particularly in areas reliant on deep gas exploration.

Ultimately, Tristone argues that a more nuanced, investment-sensitive royalty design — such as a depth-based incentive structure and moderate post-payout oil sands royalties — would better balance fiscal returns with long-term growth.

Read the full Tristone Royalty Review here.

Update for 2025: Lessons Learned and the Evolving Reality

Seventeen years later, many of Tristone’s concerns proved prescient — but not entirely. Alberta did see a significant slowdown in capital spending in the late 2000s and early 2010s, particularly in deep gas and non-integrated bitumen projects. However, global factors such as the shale gas revolution, shifting oil prices, and increasing ESG pressures also played a critical role in shaping investment flows.

Since 2015, Alberta’s royalty regime has undergone further reforms to introduce greater flexibility, including price-sensitive formulas and project-specific terms for oil sands. The original fear of a “mass exodus” of capital was tempered as global capital adjusted to post-2014 oil realities and carbon policy pressures. Notably:

Deep gas drilling has declined, but the shift was more due to North American oversupply than provincial policy alone.

Oil sands production recovered, buoyed by technology improvements, cost-cutting, and global demand for heavy crude, though new greenfield projects have slowed.

The concept of "fair share" has evolved to now incorporate climate risk, energy transition, and Indigenous participation — factors mostly absent from the 2007 debate.

In today’s policy context, Tristone’s emphasis on investment climate and return on capital remains highly relevant. However, Alberta's competitive edge is now judged as much by ESG metrics, carbon pricing clarity, and infrastructure certainty as by royalty formulas. A “fair share” in 2025 must balance investor confidence with the province's long-term environmental and fiscal resilience.

Where to Now?

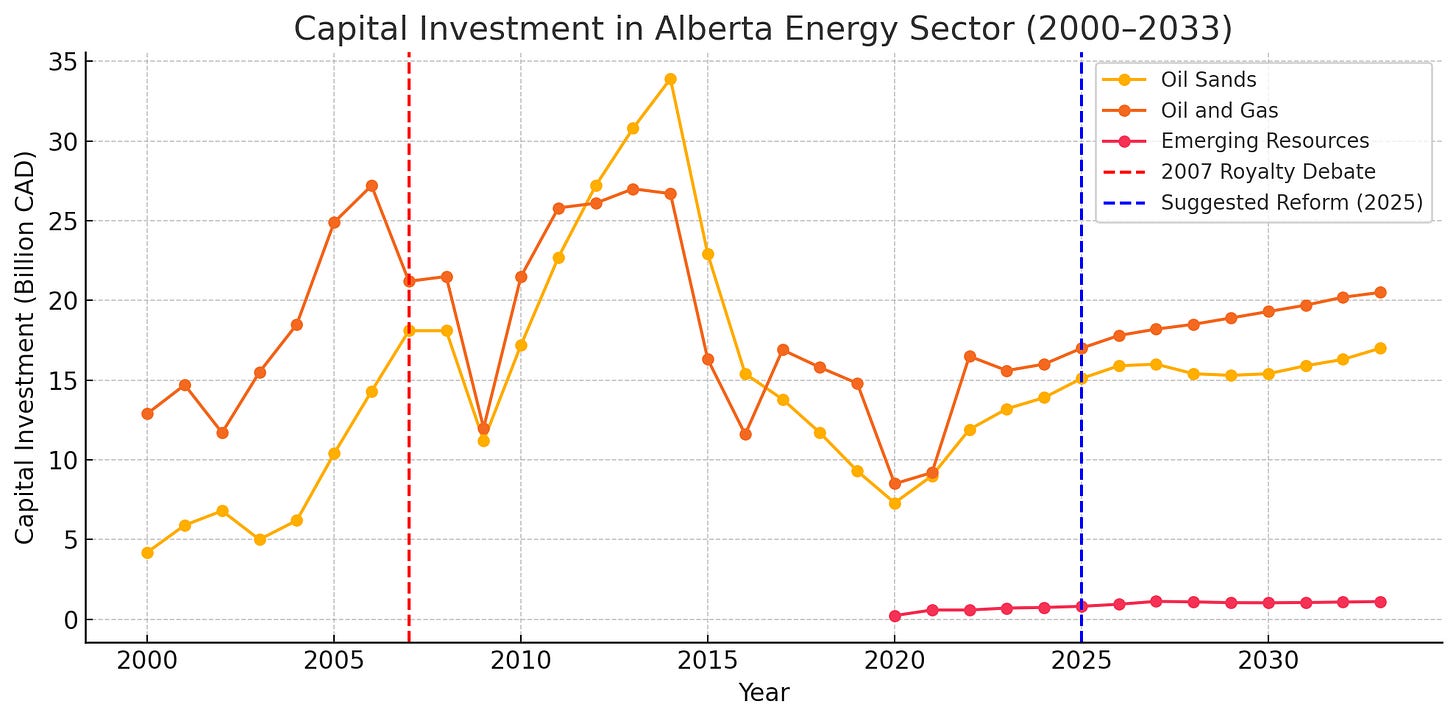

Capital Investment in Alberta’s Energy Sector (2005–2023)

The following chart illustrates the annual capital expenditures in Alberta's energy sector over the period from 2005 to 2023. The data reflects investments in oil sands, conventional oil and gas, and related infrastructure. Notable events, such as the 2007 Royalty Review, are marked to provide context to the investment trends.

2007 Royalty Review: The implementation of new royalty structures in 2007 coincided with a period of declining investments, suggesting potential investor uncertainty or reduced profitability.

Global Financial Crisis (2008–2009): A significant drop in capital investment is observed during this period, aligning with the global economic downturn.

Oil Price Collapse (2014–2016): Another sharp decline in investments corresponds with the global drop in oil prices, impacting the profitability of energy projects in Alberta.

Recent Trends (2017–2023): While there has been some recovery, investment levels have not returned to the peaks observed in the early 2000s, indicating a potential need for policy reassessment.

The figure shows historical and forecast values of capital expenditures for Alberta’s oil and gas, oil sands, and emerging resources sectors. Oil sands,crude oil and natural gas historicalvalues from CAPP. 2023 values are estimated. Emerging resource include geothermal, hydrogen, helium and lithium. Historical figures are estimated.

🔴 Red dashed line (2007): Marks the last major royalty review and debate.

🔵 Blue dashed line (2025): Indicates that a new royalty reform may be timely

Capital investment in Alberta's energy sector has experienced significant fluctuations over the past two decades, influenced by both global economic factors and provincial policy decisions. The sustained lower levels of investment in recent years suggest that it may be an opportune time for Alberta to consider another comprehensive review and potential reform of its royalty framework to enhance competitiveness and attract new investments.

Implemented Reforms

Oil Sands Royalty Structure:

Pre-Payout Phase: Projects pay a gross revenue royalty starting at 1% when oil prices are at or below C$55 per barrel. This rate increases incrementally to a maximum of 9% as prices rise to C$120 per barrel.Indigenous Services Canada+5Wikipedia+5Wikipedia+5

Post-Payout Phase: Once a project has recovered its capital costs, it pays a net revenue royalty starting at 25%, increasing up to 40% as oil prices reach C$120 per barrel. Indigenous Services Canada+6Wikipedia+6Alaska Legislature+6

Elimination of Tiered Royalty Rates:

The previous system, which had multiple tiers (e.g., "new," "old," "third-tier") for oil and gas, was replaced with a unified structure. This change aimed to simplify the royalty system and make it more responsive to market conditions. Indigenous Services Canada

Deep Gas Drilling Incentives:

Recognizing the higher costs associated with deep gas drilling, Alberta retained and revamped the Deep Gas Drilling Program. This program offers lower royalty rates over a wider price range for wells with less productivity, encouraging investment in more challenging drilling projects. Alaska Legislature

A brief summary of the current royalty framework

Alberta's royalty system is designed to be sensitive to both production volumes and market prices. Key features include:

Price Sensitivity: Royalty rates adjust based on the market price of the resource, ensuring that the province benefits more when prices are high and provides relief to producers when prices are low.

Project-Specific Rates: Each producing well or oil sands project has its own royalty rate, determined by its production volume and the prevailing market price. Alberta.ca

Bitumen Valuation Methodology (BVM): To ensure fair valuation of bitumen for royalty purposes, Alberta employs the BVM, which uses market-based benchmarks to determine the value of bitumen produced, especially when it's sold or transferred to affiliates. University of Alberta Library Guides+3Wikipedia+3Wikipedia+3

While Alberta implemented several reforms following the 2007 review, including adjustments to royalty rates and structures, some recommendations, such as a comprehensive depth-based incentive structure, were only partially addressed. The current framework continues to evolve, aiming to balance the province's need for revenue with the competitiveness of its energy sector.

The most recent comprehensive review of Alberta's royalty framework was conducted in 2015. This review led to the implementation of the Modernized Royalty Framework (MRF), which came into effect on January 1, 2017 .Alberta.ca

Key Features of the Modernized Royalty Framework (MRF):

Applicability: The MRF applies to crude oil, natural gas, and natural gas liquids from wells spud on or after January 1, 2017. Wells drilled before this date continue under the previous framework until December 31, 2026.Alberta.ca+1Canadian Energy Law Foundation+1

Royalty Rates:

Crude Oil, Condensate, and Pentanes: Royalty rates range from 5% to 40%, depending on market prices.

Methane, Ethane, Propane, and Butane: Royalty rates range from 5% to 36%, also price-dependent.Wikipedia+1Alberta.ca+1

Calculation Method: The MRF uses an "emulated revenue minus cost" approach, harmonizing the gross revenue royalty treatment across hydrocarbons.Bennett Jones+2Alberta.ca+2McCarthy Tétrault+2

Royalty Guarantee Act: Enacted on July 18, 2019, this act ensures that for a period of at least 10 years, no major changes to the oil and gas royalty structure will occur. It guarantees stability for investors by maintaining consistent royalty structures for new wells during this period.Alberta.ca

The 2015 review concluded that Albertans were receiving appropriate compensation from resource development, leading to minimal changes in the existing royalty rates but emphasizing transparency and efficiency in the system.

About the Author:

Tristone Capital (USA) Inc. is a member of the FINRA and operates as a broker – dealer in the United States. Tristone Capital Limited is authorized and regulated in the UK by the FSA. Tristone Capital (USA) Inc. and Tristone Capital Limited are affiliated with Tristone Capital Inc. This report was prepared by Tristone Capital Inc. and is being distributed in North America by Tristone Capital Inc. and in the European Economic Area by Tristone Capital Limited.Although the information contained in this report has been obtained from sources that Tristone Capital Inc (“Tristone”) and / or its affiliates believes to be reliable, we do not guarantee its accuracy, and as such, the information may be incomplete or condensed. Tristone and / or its affiliates, officers, directors and employees may from time to time acquire, hold or sell positions in the securities mentioned herein as principal or agent.

Accordingly, this report is not being held out as impartial research. All opinions, estimates and other information included in this report constitute Tristone’s judgment as of the date hereof and are subject to change without notice.

The information contained herein is for information purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. This report has not been approved by Tristone Capital Limited for the purposes of section 21 of the Financial Services and Markets Act 2000 because it is being distributed only to persons who are investment professionals within the meaning of article 19 of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005. Copyright 2007 by Tristone. All rights reserved.